Best Info For Choosing RSI Divergence Trading

Wiki Article

New Ideas For Deciding On An RSI Divergence Strategy

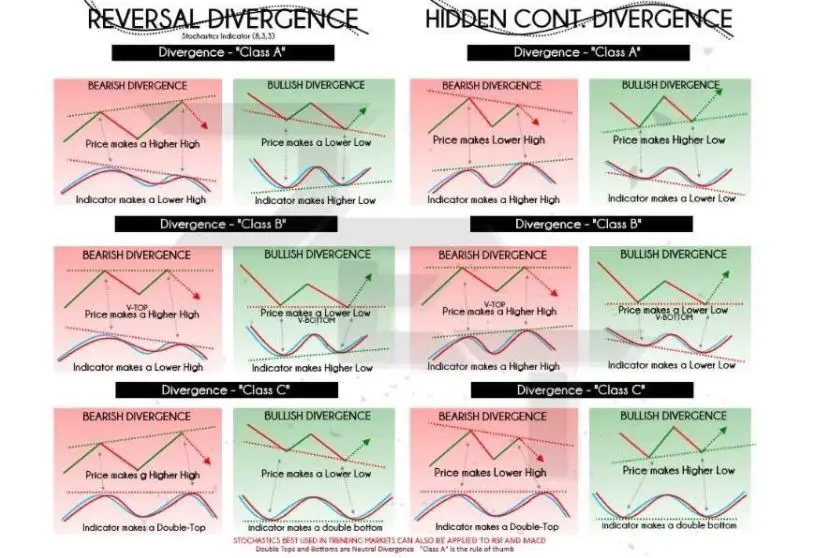

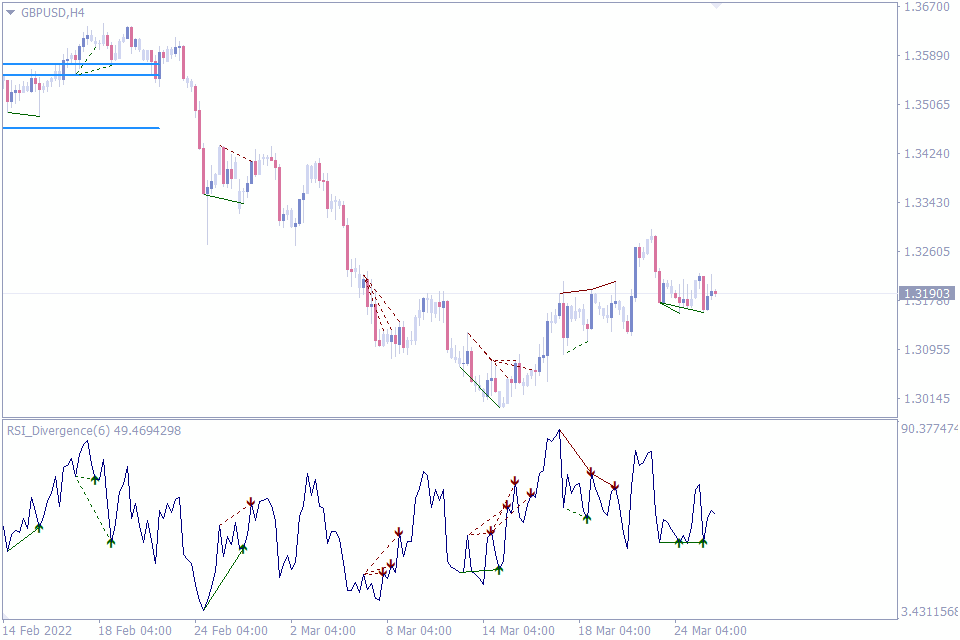

Okay, let's get started by asking the obvious question. Now, let us examine the what RSI Divergence looks like and what information about trading can be drawn from it. When the price action of your chart and the RSI signal are out of the same synchronization, a divergence is likely to occur. The RSI indicator could make lower lows when in a downtrend, but the price action is able to make lower lows. The indicator might not be in agreement with price action, and a divergence occurs when it doesn't. It is important to monitor the market when such an event occurs. The bullish RSI and the bearish RSI divergence can be easily seen on the chart. The price action was actually reversed by both RSI Divergence signals. Let's get to the fun subject. View the top cryptocurrency trading bot for website tips including forex backtesting, forex backtesting software free, automated trading, forex backtest software, backtesting platform, backtester, automated cryptocurrency trading, automated trading platform, crypto backtesting, cryptocurrency trading and more.

What Is The Best Way To Analyze Rsi Divergence?

We're using the RSI indicator to spot trend reversals. To be able to do this, it's essential to have a market trending. Then, we utilize RSI diversification to find weak points within the current market trend. Finally, we can make use of that information to determine the appropriate time to record the trend reverse.

How To Recognize Rsi Divergence While Trading Forex

Both Price Action indicator and the RSI indicator reached higher levels during the uptrend's beginning. This signifies that the trend is stable. But, at the trend's end it was evident that the price had higher highs, while the RSI indicator had lower highs. This is an indication that something should be watched in this chart. This is when we should pay be watching the market as the indicator and the price action are out from sync. It indicates that there is an RSI deviation. In this case, the RSI divergence could indicate a bearish trend. Look at this chart to see what transpired following the RSI divergence. It is evident that the RSI Divergence is very precise in identifying trends that reverse. The real question is how do you identify the trend reversal? Let's talk about four trade entry methods that give more chance of entry coupled with RSI divergence. Read the top best crypto trading platform for site recommendations including trading platform cryptocurrency, backtesting trading strategies, crypto trading bot, cryptocurrency trading, backtesting platform, best forex trading platform, divergence trading, crypto backtesting, forex backtest software, trading divergences and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Two different versions of the triangle chart pattern are accessible. The ascending triangle pattern can be used to reverse a downward trend. The other is the descending triangle pattern that is a reversal pattern in an uptrend market. The chart below illustrates the descending Triangle pattern. Like the previous instance, the market was on an upward direction, and after that the price started to slow down. RSI also indicates divergence. These signals point out the weakness of this upward trend. This indicates that the current uptrend is losing its momentum. Price has formed a triangular pattern which resembles a downward spiral. This indicates that the trend is changing. The time is now for the short trade. We followed the same methods of breakout as we did in the previous example. We will now look at the third trade entry technique. We will be combining trend structure with RSI diversity. Let's examine how to trade RSI divergence when the trend is changing. Take a look at top trading platform for site examples including position sizing calculator, forex trading, automated crypto trading, stop loss, trading platform, forex backtester, automated cryptocurrency trading, best trading platform, online trading platform, forex backtester and more.

Tip #2 – Combining RSI Divergence Pattern with the Head & Shoulders Pattern

RSI divergence assists forex traders in recognizing market reverses. Combining RSI divergence with other reversal indicators like the Head and shoulders patterns could increase our chances of winning. That's fantastic! Let's take a look at ways to time trades by using RSI divergence with the Head and Shoulders Pattern. Related: How to Trade the Head and Shoulders Pattern in Forex - A Reversal Trading Strategy. A favorable market environment is essential before we can consider trade entry. We are looking for the reverse of a trend, so it is best to be in an economy that is in a trend. Check out the chart below. Take a look at top rated automated trading for more examples including automated trading, automated forex trading, trading with divergence, backtesting trading strategies, backtesting tool, RSI divergence cheat sheet, trading platform cryptocurrency, forex backtesting, automated crypto trading, crypto trading and more.

Tip #3 – Combining RSI Diversity with the Trend Architecture

The trend is our best friend. So long as the market is trending, it is important to trade according to the direction of the trend. That's what experts tell us. The trend doesn't last forever. It will eventually change. Let's examine trend structure, RSI Divergence , and how to recognize Reversals. You've probably noticed that the upward trend is making higher highs while the downward trend is forming lower bottoms. In this regard, let's take a closer look at the chart below. On the left hand side of the chart , you'll notice a downtrend. There are many of lows and lower highs. Then, let's take another look (Red Line) at the RSI divergence. Price action creates Lows however the RSI generate higher lows, right? What does this indicate? Even though the market creates low RSI is the reverse. This indicates that the ongoing downtrend has lost momentum. It is important to be prepared for a reversal. View the recommended automated trading for more recommendations including RSI divergence, backtester, RSI divergence cheat sheet, best crypto trading platform, automated forex trading, best forex trading platform, bot for crypto trading, backtesting trading strategies, forex trading, best trading platform and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

Double bottom or double top is a pattern of reversal which is created after a long-term move or following an ongoing trend. The double top is the first top appears when the price is at a certain level that can't be broken. Once it has reached that point it will bounce down a bit, only to return back to the same level again. Double tops occur when the price bounces off this level. Double tops are below. The double top above demonstrates that the two tops were formed after a strong movement. The second one was not able to rise above the previous one. This is a strong indication that the buyers are struggling to get higher. The same principle applies to the double bottom, however it's in reverse. We use breakout entry. This means we sell the trade when the trigger line is below the price. The price broke below the trigger line, and we completed a sell trade within one day. Quick Profit. Double bottom is also a requirement for the same strategies for trading. Below is a chart which will show you the best way you can trade RSI diversgence when using the double top.

Keep in mind that this isn't your only trading strategy. There is no single strategy for trading that is flawless. Additionally, all trading strategies experience losses. We earn consistence profit from this trading strategy BUT we're using a tight risk management and a method to cut our losses quickly. That way we can minimize our drawdown and also open the doors for big upside potential.