Great Info For Deciding On Forex Trading Bots

Wiki Article

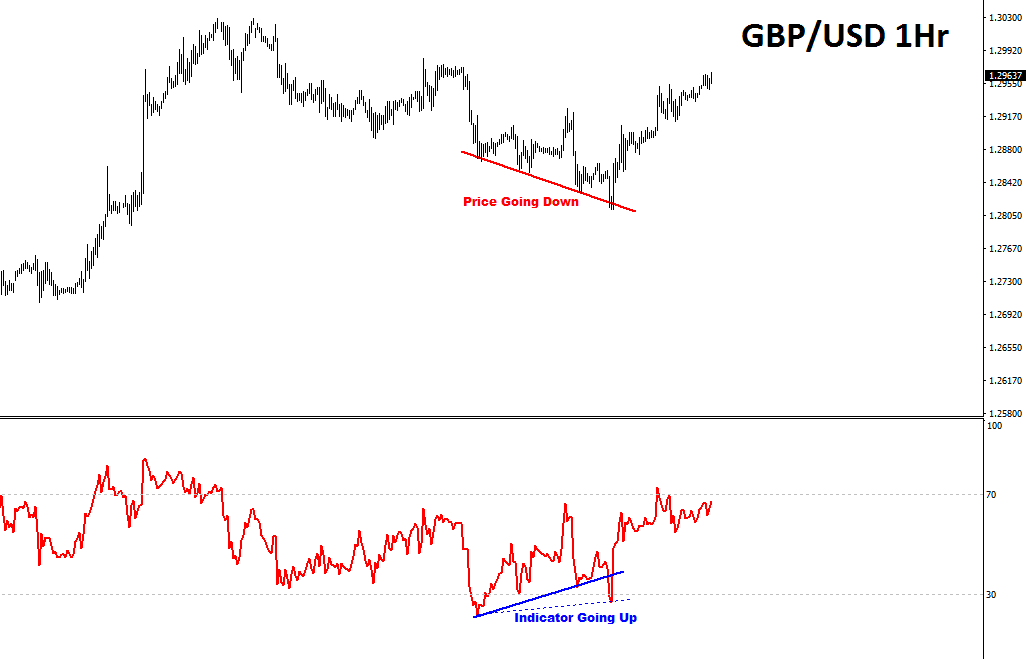

What Are The Most Important Factors That Determine Rsi Divergence

Definition: RSI diversence is a technique used for technical analysis to compare the direction of an asset's changes and the direction of the relative strength indexes (RSI). Different types There are two types of RSI divergence: regular divergence or concealed divergence.

Signal: A positive RSI divergence is considered to be an indicator of bullishness, while any negative RSI divergence is regarded as bearish.

Trend Reversal RSI Divergence can signal a trend reversal.

Confirmation RSI diversification should be used along with other analysis methods to provide a proof.

Timeframe: RSI divergence is possible to be observed over various timeframes to gain different insight.

Overbought/Oversold RSI numbers that exceed 70 mean the overbought condition, while values lower than 30 signify oversold.

Interpretation: In order to interpret RSI divergence properly, you need to be aware of other fundamental and technical aspects. View the best automated forex trading for more info including crypto trading, crypto trading bot, best forex trading platform, divergence trading, forex backtester, divergence trading forex, stop loss, forex backtesting, backtesting trading strategies, RSI divergence cheat sheet and more.

What Is The Difference Between Regular Divergence And Concealed Divergence?

Regular Divergence - This is when an asset's price is at an upper or lower level than the RSI. This could be a sign of a trend reverse, however it is essential to consider other fundamental and technical factors. Hidden Divergence: when an asset's price makes lower highs or lower lows, when the RSI makes a higher or lower low. While this indicator isn't as strong as regular divergence it could still signal a possible trend reversal.

The technical factors to be considered:

Trend lines and levels of support/resistance

Volume levels

Moving averages

Other technical indicators and oscillators

It is vital to be aware of the following:

Economic data are released for release

Details specific to your company

Market sentiment and indicators of sentiment

Global events and the impact of markets

It is essential to consider fundamental and technical aspects prior to making investment decisions that are based on RSI divergence signals. Have a look at the top trading platform cryptocurrency for more advice including automated trading, forex backtester, automated trading platform, automated crypto trading, stop loss, automated crypto trading, forex backtesting software free, backtesting tool, forex backtesting software, divergence trading and more.

What Are Backtesting Techniques For Trading Crypto

Backtesting crypto trading strategies involves simulating the use of a trading strategy using historical data in order to evaluate its efficiency. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Define the trading strategy that is being evaluated with regard to entry and exit rules size of positions, the rules for managing risk.

Simulator: Use software to test trading strategies using historical data. This allows one to observe how the strategy will perform over time.

Metrics. Make use of metrics such as profitability and Sharpe ratio to evaluate the effectiveness of your strategy.

Optimization: Adjust the strategy's parameters and run the simulation once more to optimize the strategy’s performance.

Validation: Check the effectiveness of the strategy using data that is out-of-sample in order to test its reliability.

Remember that past performance isn't an indication of future results and results from backtesting should not be relied on to guarantee future profits. You should also consider the volatility of markets and the costs associated with transactions when using the strategy to conduct live trading. Follow the recommended divergence trading forex for website recommendations including best crypto trading platform, backtesting platform, crypto trading, crypto trading bot, cryptocurrency trading bot, crypto backtesting, backtesting, cryptocurrency trading bot, stop loss, backtesting platform and more.

How Do You Evaluate Forex Backtesting Software While Trading Using Divergence

When considering the backtesting of forex software that is designed to trade with RSI diversification, there are a few crucial aspects to take into consideration Accuracy of data: Make sure that the software is able to access easily to historical and correct data regarding the currencies being traded.

Flexibility: The software should permit customization and testing different RSI divergence strategies.

Metrics: The software should offer a variety of indicators to measure the performance of RSI diversence trading strategies. These include profit, risk/reward ratios and drawdown.

Speed: Software should be quick and efficient to enable rapid backtesting of different strategies.

User-Friendliness: The software should be user-friendly and easy to comprehend, even for people who do not have a deep understanding of technical analysis.

Cost: You must take a look at the cost of the software to determine if it is within your financial budget.

Support: Good customer support should be provided, including tutorials as well as technical support.

Integration: The program must be able to integrate with other trading tools including charting software and trading platforms.

Before you purchase a subscription, it's important to try the software out first. Read the most popular automated crypto trading for more examples including RSI divergence cheat sheet, forex backtesting software, forex backtester, forex backtesting software, automated trading software, crypto trading backtesting, automated cryptocurrency trading, automated trading, backtesting strategies, RSI divergence cheat sheet and more.

How Do Robots For Trading In Cryptocurrency Function In Automated Trade Software?

These bots trade cryptocurrency by using automated trading software. They use the pre-defined rules for executing trades on the users' behalf. This is how they work: Trading Strategy: The user defines the trading strategy, which includes entry and exit rules as well as position sizing and risks management guidelines.

Integration: The trading bot integrates with an exchange for cryptocurrency via APIs, allowing it to get access to live market data and execute trades.

Algorithm is a method that the bot uses to analyse market data in order to make decisions based mostly on trading strategies.

Execution: The robot performs trades automatically , based on the trading strategy without any manual intervention.

Monitoring: The robot continuously examines the market and adjusts the trading strategy as required.

The usage of robots to trade cryptocurrency is useful in executing complex or repetitive trading strategies. This eliminates the need to manually manage the process and allows the trader to benefit from market opportunities throughout the day. It is important to recognize that automated trading can have its own risks. Security weaknesses, and losing control over trading decisions are some of the possible dangers. Before you use any trading robot for live trading, it is crucial to evaluate it thoroughly and test it.